We identified various barriers that make it challenging to launch a product in a specific market. We address these barriers and provide assistance in several forms. (see also the roadmap on the projects homepage .

How to comply with European legislation?

In the section below the medical device regulation is shortly described and we will provide you with information and tools that will help your company to solve the challenges:

- Understand and get an overview of the MDR/IVDR

- Share and get knowledge

- Get contacts for clinical investigation/collaboration

- Getting access to a notified body

Actions to comply with European legislation (MDR)

The section on the right of this page displays networks where you can become a member to gain help and support while you try the following:

- Exchange experience with companies from your own network

- Register in cluster organisations

- Participate in a knowledge exchange through networking

- Organise workshops for knowledge exchange

- Appoint an adviser

- Found a special department

- Find and hire a specialist for the company

- Hire an external service provider

- Obtain an overview of MDR, notified bodies and Eudamed

- Participate in webinars

Background information (MDR)

The Medical device regulation (MDR/IVDR) replaces the Medical device directive (MDD) originates from start/middle 90. The MDR is a result of scandals and incidents with medical devices. The MDR covers all medical devices including active medical devices and is significantly more comprehensive and detailed compared to the MDD.

The key changes in the MDR is classification according to risk, contact duration and invasiveness, further expansion of the product scope. The requirement for documentation, clinical evaluation, postmarket clinical follow-up and traceability is significantly increased for all risk classes.

The European Database on Medical Devices (EUDAMED) provides an information exchange system between the European commission and the competent authorities. The Unique Device Identification (UDI) and EUDAMED shall improve the traceability. EUDAMED will now also store information regarding the postmarket surveillance activities.

All European notified bodies for medical devices will lose their designation as of the date of application of the MDR and IVDR due to the change in the legal framework and must therefore be redesignated under the MDR. All notified bodies are published on the NANDO database.

Links

Services related to MDR

Here you can participate in courses and webinars.

- Medico Industrien academy (Danish and English courses)

- CE-forum, maskinsikkerhed (DK)

- BSI group, worldwide

Understand the structure of the healthcare systems

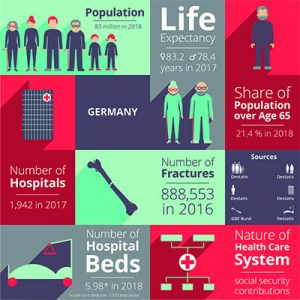

- The sharing of decision-making powers between states, the federal government and self-regulated organisations of payers and providers; and

- The separation of Public/Statutory Health Insurance (SHI) (including the social LTCI) and Private Health Insurance (PHI)(including the private LTCI).

SHI and PHI use the same providers. Hospitals and physicians treat both statutorily and privately insured patients, unlike hospitals in many other countries. Private insurances influence the German market, whereas they play a minor role in the Danish market. However, 2,9 million Danes have additional private health insurance, “cepos“.

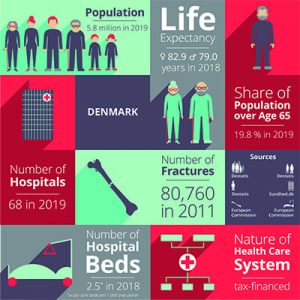

Denmark

Downloads

Further contacts:

Germany

- Federal Institute for Drugs and Medical Devices – EN Medical devices/DE Medizinprodukte

- Get on overview of the Catalog of assistive devices (DE)

- Apply to have your medical devices included in the catalog of assistive devices (DE)

Downloads

Webinars

Background information on the healthcare systems in brief

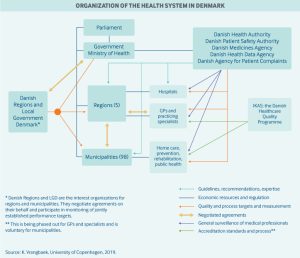

Healthcare in Denmark is provided by the local governments of the five regions, with coordination and regulation by central government, while nursing homes, home care, and school health services are the responsibility of the 98 municipalities.

Healthcare in Denmark is provided by the local governments of the five regions, with coordination and regulation by central government, while nursing homes, home care, and school health services are the responsibility of the 98 municipalities.

Danish government healthcare expenditures amount to approximately 10.4% of the GDP, of which around 84% is funded from regional and municipal taxation redistributed by the central government. Because basic healthcare is taxpayer-funded, personal expenses are minimal and usually associated with co-payments for certain services. Those expenses are for the most part covered by private health insurance.

Use of electronic health records is universal, and efforts are underway to integrate these at the regional level. For every 1,000 people in Denmark, there are about 3.4 doctors and 2.5 hospital beds. Spending on hospital facilities, at 43% of total healthcare spending, is above the average for OECD countries, even though the number of beds has decreased considerably in the last decade.

In Germany, the principle of self-administration applies: Although the Federal state sets the legal framework and tasks, the insured and contributors as well as the service providers organise themselves in associations that are responsible for providing medical care to the population.

The Federal state holds most university hospitals, while municipalities play a role in public health activities and hold about half of all hospital beds. Patients health insurance covers costs that are directly associated with the treatment in the hospital. The State in which the hospital is located finances so-called ‘investment costs’ such as diagnostic machinery, ambulance vehicles, and building maintenance. Source: “Report: Comparison of the Danish and German healthcare system“

The German health care system is supported and self-managed by many institutions and actors. The core area, also known as the first healthcare market, comprises the area of “classic” health care, which is largely financed by statutory health insurance (SHI) and private health insurance (PHI) including nursing care insurance. All privately financed products and services related to health are referred to as the second healthcare market. Source: “Bundesgesundheitsministerium – Gesundheitswirtschaft im Überblick“

- Aquire knowledge about the reimbursement process

- Take part in the tender process

- Find and hire an expert of/for the tender process

- Register at international cooperation exchanges for partner search

- Find a partner for the distribution of your product

Target market Denmark

The Danish medical industry in numbers

About 250 companies in Denmark work dedicatedly with the various branches of the medical industry. But in total, just over 1,000 companies are to a greater or lesser degree employed in the medical field. The 20 largest companies account for approx. 75 pct. of revenue. 2/3 of the companies in the industry have less than 50 employees. The Danish market for medical devices accounts for 0.5% of the global market. Expenditure on medical equipment amounts to approx. 5 pct. of the total public expenditure on our healthcare system “Espicom”

The public health service via the five regions is the largest buyer of the industry’s products. Other customers are municipalities (e.g. in connection with care and rehabilitation), private hospitals or private citizens. In 2014, the USA was Denmark’s largest export market for medical equipment, with 25% of exports. This was followed by Germany (15%), Sweden (6%), Japan (4%) and China (4%). “Espicom”. Over 95 pct. of Danish production is exported.

Link

- Reimbursement of medical devices in Denmark

- Way of acquisition in elderly care in Denmark (overview table of the Demantec project)

- Go-To-Guide for Implementation in elderly care in Denmark (EN, DK) (Demantec project)

Webinar

Target market Germany

Compared with the economy as a whole, the healthcare industry is showing above-average growth rates. At 4.9% per year, it has grown faster than the German economy as a whole over the past ten years. The German healthcare industry employs 7.6 million people and generates almost 370 billion euros. This corresponds to a share of 12.1 per cent of gross domestic product. The industry contributes to achieving key economic policy objectives and influences them in terms of adequate and steady economic growth and high employment levels.

Medium-sized companies dominate the MedTech sector in Germany. 93 per cent of MedTech companies employ fewer than 250 people. There are 13,000 micro-enterprises alone with around 60,000 employees. Only 90 MedTech companies in Germany have more than 250 employees. The MedTech industry is innovative and has very short product cycles. German medical technology manufacturers generate about one-third of their turnover with products that are not older than 3 years. “BVMed – Branchenbericht Medizintechnologien 2020”.

Links

- Reimbursement of medical devices in Germany

- Finding your way into the German medical device market

- Go-To-Guide for Implementation in elderly care in Denmark (EN, DK) (Demantec project)

Webinars